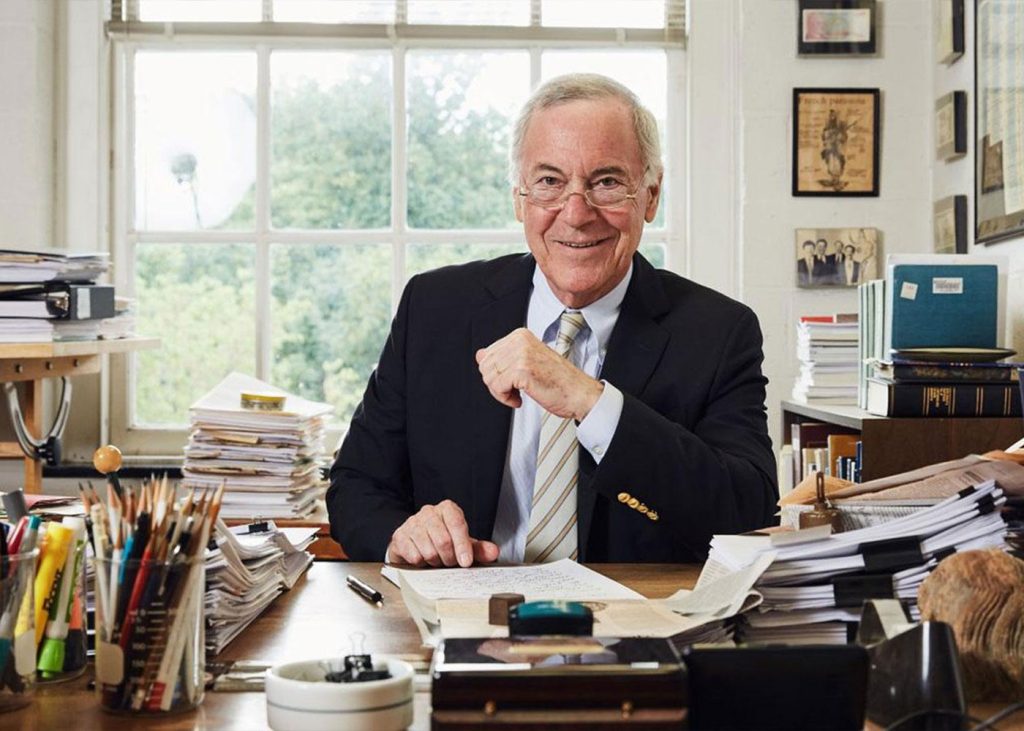

Prominent applied economics professor and Johns Hopkins University scholar Steve Hanke is well-known for criticizing the popular cryptocurrency bitcoin (BTC). On March 26, he shared yet another statement on Twitter. Let us discover what that renowned economist had to say about BTC!

According to Steve Hanke, Bitcoin is a Speculative Asset

According to a report from Morgan Stanley, Bitcoin (BTC) is more of a speculative asset than a currency, a view that economist Steve Hanke seems to agree with. Hanke recently tweeted that the flagship cryptocurrency is a highly speculative asset, not a currency like the Dollar, Euro, or Yen. He went on to say that the fundamental value of Bitcoin is zero.

The recent surge in the price of Bitcoin may be what prompted Hanke to make these statements. Bitcoin has been trading around $27,000 for a while, but it recently experienced a significant increase due to the banking crisis in the United States. This has demonstrated that Bitcoin could serve as a hedge against inflation during times of economic crisis. However, despite its perceived benefits as a hedge against inflation, Hanke remains critical of Bitcoin and views it as a highly speculative asset with no fundamental value.

Steve Hanke Commented on TRON’s Creator Justin Sun

The SEC recently announced the indictment of crypto entrepreneur Justin Sun for fraud on March 22, alleging that he had violated securities laws in various ways. The regulator also indicted eight celebrities for illegally promoting Sun’s crypto securities. The Economist commented on the SEC’s action on March 26.

Steve Hanke responded to the news by suggesting that cryptos are primarily associated with crime and scams. Hanke specifically mentioned the recent indictment of Justin Sun, who had paid celebrities such as Lindsay Lohan, Austin Mahone, Jake Paul, and Lil Yachty to promote his Tronix crypto. Hanke characterized Sun as another crypto scammer who associates with celebrities with little industry knowledge.

In the past two weeks, several major US banks have failed, causing a banking crisis and leading to the shares of financial institutions like Deutsche Bank falling. At the same time, the crisis has contributed to a surge in Bitcoin’s price, as analysts see it as a potential hedge against inflation. Against this backdrop, Tim Draper has recommended that businesses hold Bitcoin.