While cryptocurrency rules are still being defined, crypto pump-and-dump groups promote unknown currencies over Discord and Telegram. Pump-and-dump activities, which fraudulently influence prices by spreading misleading information, have been around since the 1700s. Con artists with holdings in the South Sea Company, for example, began making misleading representations about the company’s income in the early eighteenth century.

The objective was to artificially increase the stock price before selling it to naïve people who were misled into believing they were participating in a promising product. Con artists today are following in their footsteps with a pump-and-dump scheme known as the South Sea Bubble.

How did these Crypto Pump-and-Dump Groups Emerge?

With the emergence of blockchain technology along with the rise of cryptocurrency trading, the problem has grown larger and more serious. Government regulations have lagged, and cryptocurrencies are particularly vulnerable to market manipulation.

The internet’s various crypto pump-and-dump groups have varied levels of activity. Every day, the busiest do one pump-and-dump cycle. Less active groups might only do one operation every week. Other groups operate when they believe market circumstances are favorable. So, is it possible to make money by pumping and dumping cryptocurrency?

Why are Crypto Pump-and-Dump Groups Illegal?

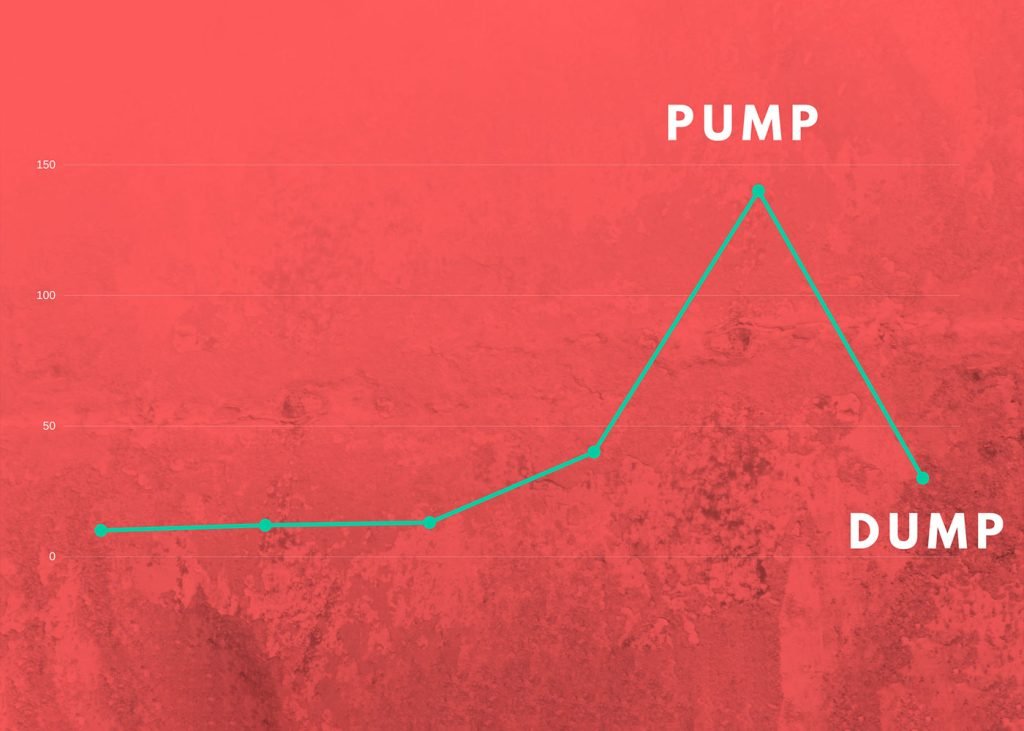

There may be an opportunity to profit since a pump-and-dump strategy involves artificially increasing the value of a crypto asset immediately before a planned and unexpected drop. Yet, if you don’t sell the unknown coins soon enough, you’ll be stuck with them for a long time. Please keep in mind that nothing is guaranteed in the turbulent cryptocurrency market; thus, as a precautionary measure, learn the fundamental crypto metrics to prevent falling for schemes that look “too good to be true.”

When information about unknown currencies is spread in Discord and Telegram channels, you may wish to inquire whether crypto pump-and-dump groups are legal. Pump-and-dump trading is banned in the stock market, but because most cryptocurrencies are not regarded as securities, cryptocurrency markets are usually in legal ambiguity. As a result, while pump-and-dump crypto schemes are ethically and legally questionable, they may not break any current laws. Yet, authorized cryptocurrency exchanges consider such schemes to be unlawful.